Life insurance is an essential element of a comprehensive financial plan. In fact, it is the safest way to protect your family or dependents from unforeseen circumstances says Randon James Morris.

People purchase life insurance to provide financial freedom to their dependents when they are no longer around to provide help. If you need life insurance, it is crucial to know how much and what kind you require. Let’s have a look what is life insurance, how much and what type to own.

What is Life Insurance?

A life insurance is a contract between an insurance company and a policyholder. The companies will pay an assured amount of money to the nominated beneficiary in an unfortunate event. In exchange, policyholders agree to pay a predefined amount of money on a regular basis.

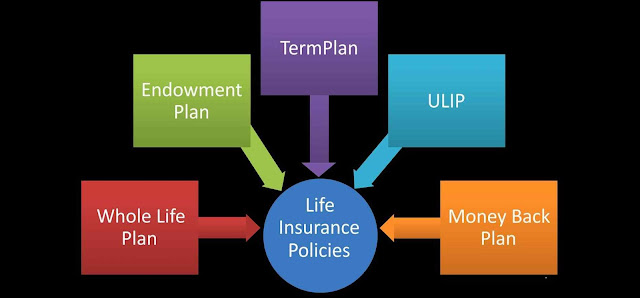

Here’s the different type of life insurance plans:

1 . Money back life insurance: This type offer periodical compensation of partial survival welfares during the tenure of the policy and policyholder is alive. Moreover, in case death of an insured person, the insurance business pay the full amount assured along with existence benefits.

2 . Term insurance: It is the form of insurance that offers financial protection for a specified tenure. Term insurance makes sure that policyholder’s family get a large lump sum amount after his/her death in order to lead a financially stable life.

3. Child insurance: Actually, an upsurge in education cost is causing unease among parents. Hence, it is sensible to invest in a child insurance plan to give a financially secured life to your child even in your absence.

4. Whole life insurance: This type of life insurance offer the dual benefit of insurance as well as investment. Furthermore, it offers insurance coverage for the whole life of a person emphasis Randon James Morris.

5. Pension plans: Life insurance companies’ offer pension plans to help people construct a retirement corpus. This money helps people to spend a financially secured life even after retirement.

These are some types of life insurance from which you can select anyone that best fits your needs. You can also purchase insurance through an agent. This will prevent you getting stuck with insufficient coverage or expensive coverage you don’t require.

How Much Insurance Do You Need

There are numerous decisions to make. A general method to buy insurance is based on income replacement. In this method, a formula of between 5 and 10 times your yearly salary is used to compute how much coverage you need.

Another method is to purchase insurance policy based on your individual requirements and preferences. The first step is to define your income replacement needs as they may vary greatly depending on your age.

Nowadays, a large portion of income goes to taxes and to support your own lifestyle as well. You should start by determining net earnings after taxes. Add up all your personal expenses like clothing, club membership, food, transportation etc. And subtract this from your net after-tax earnings, the reminder signifies yearly income that your insurance may need to exchange.

You want a demise profit amount, which, when invested, will offer income yearly to cover this amount. Hence you should also add face value amounts required to fund one-time expenditures such as college tuition for your broods. Lastly, estimate your own personal expenditures like uninsured medical costs, estate taxes, and funeral costs.

WRAPPING UP

Randon James Morris has shared his thoughts on what is life insurance and what type to own. The biggest defy concerning to a life insurance scheme is related to opting the right type of insurance policy. A financial professional can help you evaluate your life insurance requirements by implementing a life insurance needs analysis.

Nice Post thanks for the information, good information & very helpful for others. For more information about Atal Pension Yojana Atal Pension Yojana, APY, Atal Pension Scheme

ReplyDeleteAtal Pension Yojana, APY, Digitize India Platform, DIGITAL INDIA PLATFORM, Apna CSC Online Registration, CSC Apply

Mobile Number Tracker, Pubg Mobile, Free Royale Pass pubg, career counselling, career counselling online, online career counselling free, online counseling,

It's a highly informative post about insurance. Helpful for those who are looking for a good insurance policy. Health Insurance From GIBL

ReplyDelete