In the 21st century, women are empowered, self-made, and independent who are working shoulder to shoulder with men in almost every profession. Further, their contribution in savings has become very essential to maintain the standard of living and to build better future of their children. Randon James Morris says today, many women are encouraged to become a bread earner, and they have proved themselves as breadwinners. Further, he says, if we talk about insurance and life protection, then, unfortunately, they don’t value their own worth and neglect financial protection offered by life insurance to cover many risks in life.

Below are the points that describe the important reasons why women need to take life insurance.

Financial Protection

The protection of a family is our first priority, but what if you are not there to protect them? If you are capable enough to share the financial responsibility with your partner, you must not compromise on protecting your financial responsibility.

Getting financial protection with life insurance will give you satisfaction and mental peace that your family will be protected in future in case you are not with them anymore.

Grow Savings with Insurance Plan

Gone are the days when women use to do small savings from the monthly budget. Nowadays, an independent and career-oriented woman is capable enough to do more than that to save money.

If you are an independent woman and looking for the best financial planning, you can go for the life insurance. Many insurance products are there for women to contribute in the growth of savings to provide a family a better lifestyle.

Cover for Critical Illness

Life is uncertain, and health issues are increasing day by day. Further, with the increasing medical expense’s it becomes difficult to get quality treatment at the right time. Many times families do not have financial position to pay the medical bills. And this is where insurance policy that covers life risk along with critical illness protection plays a great role. Even if a person dies with critical illness, then also family gets balance amount according to the policy agreement which somehow family to deal with future expenses.

Cost-effective

According to experts, a life expectancy of a woman is more than a man. Therefore, insuring woman is more beneficial and less risky for insurance companies. And this is the reason most life insurance plans offer females better rates over males. This is what makes life insurance cost-effective and an attractive opportunity that offers lots of benefits, financial savings, and life coverage.

So, what are you waiting for? Get yourself insured with the best insurance plan and grab the amazing benefits.

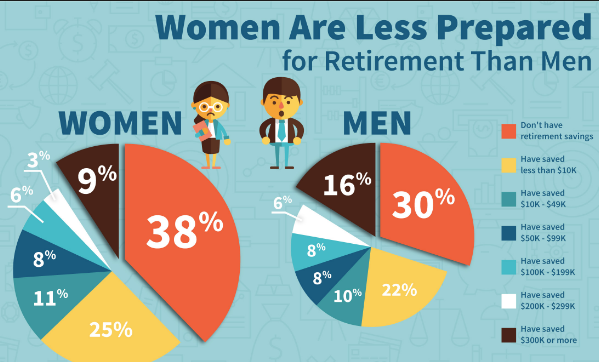

Saving for Retirement

If your husband has invested in a retirement plan, but it does not make your future strong to overcome financial worries in your old age, this is where you need to think something for yourself. In addition, it becomes challenging to maintain the higher standard of living by depending on one person’s retirement, especially when the inflation rate is rapidly growing.

To enjoy stress-free retirement life, you need systematic financial planning. And for this, you can choose best insurance products that can make your retirement enjoyable.

FINAL WORDS

Life insurance is very important in the life of every working woman as they play an essential role in handling household expenses. Therefore, it is very important to choose the right life insurance plan which offers you adequate coverage as per your need and requirement. According to Randon James Morris, if you want a peaceful and stress-free life for your family, understand the importance of life insurance in your life.

Source By : Randon James Morris

Comments

Post a Comment